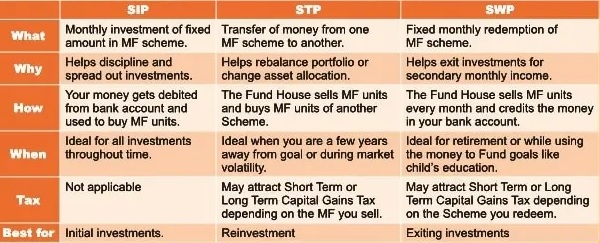

STP is a convenient tool for transferring a fixed amount at regular intervals from one fund to another, helping you maximize your investments.

Important Note

Mutual Fund Investments are subject to market risks. Please consult with a financial advisor before making investment decisions.

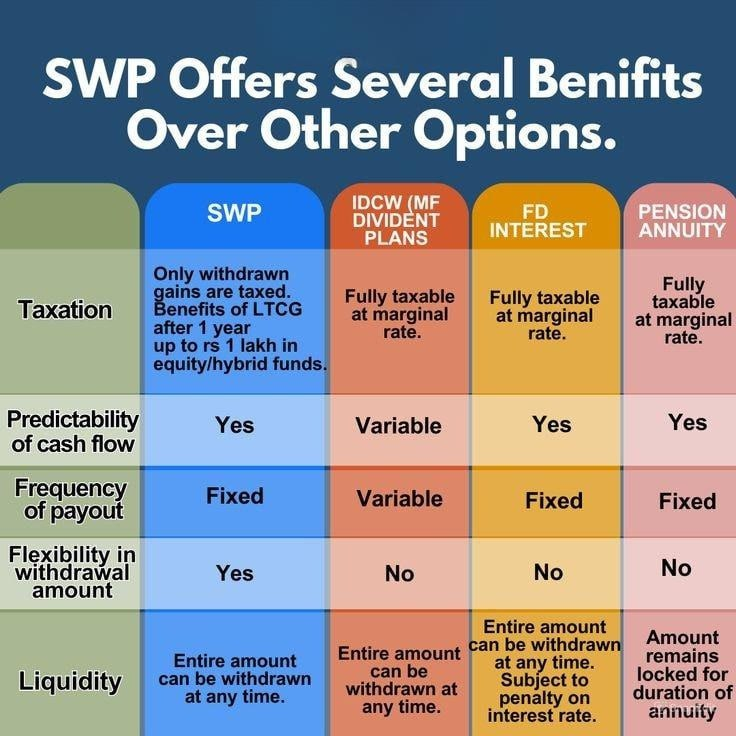

A Systematic Withdrawal Plan (SWP) allows investors to withdraw a fixed amount at regular intervals, providing a steady income stream.

How SWP Works:

Benefits of SWP:

In Summary:

SWP is a valuable facility for investors seeking regular income or wanting to create cash as they approach their financial goals, while mitigating emotional decision-making. However, it's crucial to understand the associated market risks and carefully review scheme documents before investing.

Important Notes:

Remember, SIP is a powerful investment tool that can help you achieve your financial goals with discipline and patience!

Note for ELSS SIP / STP :- Your SIP investment in ELSS, i.e. Tax saver fund, that your SIP investment in ELSS Tax saver fund is a 3 year lock-in from the date of investment of each installment, it means you can withdraw your money after completion of 3 years from the date of each & every SIP installment. It applies FIFO method i.e. first in first out.